Summary

Are you ready to unlock the secret to earning passive income through real estate investments as we head into 2024? In this article, you’ll learn about Fundrise, an online real estate investing platform. I’ll show you how to do it with as little as $10! You won’t need to spend tens of thousands of dollars getting into real estate investing the traditional route. Fundrise has changed the real estate investment game. It lets investors get started from the cozy comfort of their couch. Start your financial freedom journey now and hit the ground running in 2024!

Table of Contents

- Introduction

- Pain Points in the Standard Approach

- What is Fundrise and How Does it Work?

- Getting Started With Fundrise

- Fundrise’s Investment Options

- Is Fundrise Right for You?

- A Special Offer – Get $50

- Conclusion

Introduction

Would you like to invest in real estate but don’t have tens of thousands of dollars to put down on property? Or even the time to search for suitable properties to buy and purchase to enter the real estate game? I know that feeling, and today, I will share a real estate investing platform that allows you to invest in real estate without leaving your couch.

Please read until the end because I have a special offer for you regarding investing in real estate without having tens of thousands of dollars and doing it efficiently.

A few years ago, I started to think about what type of financial legacy I wanted to leave for my family, friends, and faith community. I thought about investing in real estate and began researching the topic. Most real estate investing strategies took tons of time and typically took tens of thousands of dollars to get started.

Real estate is one vehicle to build the financial lifestyle you want and leave a legacy to your family; I knew that. Yet, I needed the means to invest in it the traditional way. So, I started looking for alternatives to typical real estate investing approaches.

I found Fundrise, a real estate investing platform that allows me to be active or passive in all types of real estate deals. By the end of this article, you’ll know if Fundrise is the right investment vehicle for you.

Prohibitive Pain Points of Traditional Real Estate Investing

The standard pathway for real estate investing comes with many pain points. I recently read an article on Fool.com (Motley Fool is a prevalent investors’ education site) stating, “According to the Federal Reserve Bank of St. Louis between 1980 and 2020, the median home sales price in the U.S. increased by 416%. From 1980 to the third quarter of 2023, home sales prices rose 576%.” I live in Florida, where a typical home costs $400,000 plus (according to the Zillow Home Value Index). The Zillow stat does not consider the part of the state the house is in because, for the luxurious locations of the state, $400,000 isn’t even a conversation starter.

Let’s say the home you want to buy as an investment is on the market for $570,000. If you’re putting up 20%, you’re out of pocket $115,000. Not to mention the remodeling cost, fees, taxes, etc. Traditional real estate investing is cost-prohibited for the average American. Thankfully, with the advancement in technology, there is a better way.

Thankfully, technology has broken down many barriers, and regular, ordinary, everyday people can now get into the real estate game on their terms. Next, we will dive into a real estate investment platform called Fundrise:

- What is it?

- How does it work?

- What are the different investment plans on the platform?

- Now, you can get started on this platform with an investment as small as $10!

What is Fundrise and How Does it Work?

The simple answer to that question is “a crowdfunding platform.” You’ve likely heard about other crowdfunding platforms, like Kickstarter, GoFundMe, and Indiegogo.

Let’s take Kickstarter, for example. Say you’re an inventor and want to bring your invention to the market, but you want to avoid licensing with a big conglomerate. You would use Kickstarter to talk about your invention, and people worldwide would see your invention idea and donate money to help you manufacture it.

Fundrise is also a crowdfunding platform; however, the focus is specifically on real estate investments. Like with other crowdfunding platforms, Fundrise pools the funds of all their investors.

Then, Fundrise’s team of experts finds various real estate deals. Examples could be:

- A newly planned subdivision in Portland, Oregon, where the builder needs financing for the project. Fundrise might loan the builder 50% of the funding with an agreed-upon repayment interest rate. Once this loan is repaid, it benefits you as an investor.

- The owner of ten three hundred-unit apartment complexes in Atlanta, Georgia, is offloading the properties from their portfolio. In this instance, Fundrise might buy the apartment buildings, becoming the new landlord. In this scenario, as an investor on Fundrise, you’re now an apartment building owner minus all the headaches!

Those are just a few examples of the different investment opportunities using Fundrise. I’ll talk about other things that have come up with Fundrise since the platform launched. One of the beauties of Fundrise is they take the stress out of being a real estate investor.

- You don’t have to think about sourcing the properties.

- You don’t have to think about the legalities.

- You don’t have to think about the fees or anything like that.

There is openness and transparency in the fee structure (this is an investment platform) and clarity in the type of investments that sit in your portfolio.

Question. Does the money manager of your 401K at work send you weekly emails explaining which investment paid back and what investment they’re making next? Of course not! That never happens (outside your quarterly account summary). That is not the case with Fundrise. As an investor, I get email updates all the time, telling me things like, “We just saw this great commercial building opportunity in Nashville, Tennessee, and your portfolio now owns a piece of that property.” It feels fantastic to log in to my Fundrise dashboard, where I can see the properties I own (without having to do all the leg work to acquire them).

Getting Started With Fundrise

When I started on the platform (June 2020), the minimal investment was $500. That is no longer the case. Today, you can start investing on the platform for far less than that.

Again, please read to the end because I have a special offer. Below, you’re looking at a screenshot of the Fundrise website.

“Invest in a better alternative. Build a portfolio of private assets like real estate, private credit, and venture capital. Start investing in less than 5 minutes and with as little as $10.”

What makes this platform so special? Right now, over 2 million people are using the platform.

And Fortune Magazine wrote, “Fundrise is opening the gates to this most privileged of enclaves, marshaling a business model that melds PE-like (private equity) funds and fintech to help people buy real estate stakes with investments as low as $10.”

The Wall Street Journal wrote, “A startup that wants to open up the single-family home rental market to small investors is ramping up its home purchases after winning the backing of Goldman Sachs Group Inc.”

Historically, real estate and venture capital investing were cost-prohibitive for small investors and limited to accredited VCs and institutional investors. Using crowdfunding as its foundation, Fundrise has smashed through those barriers. Fundrise has found the way to find that sweet spot, the balance of giving people control over how they invest on a platform or allowing people to be less involved regarding their investments.

Fundrise Investment Options

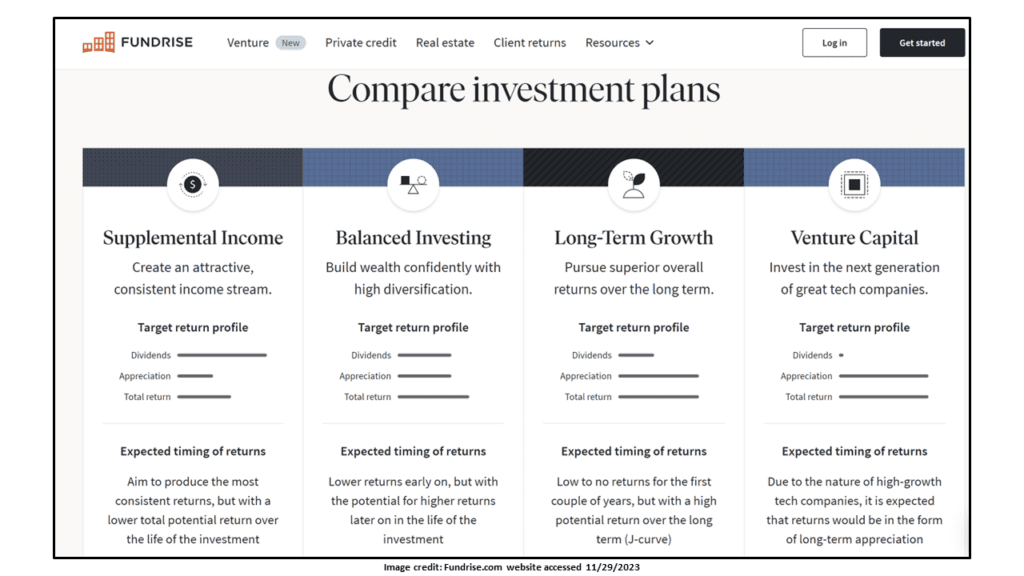

Just like if you were signing up for your company’s 401K retirement plan, you would first assess the type of investor you are. For example, do you want to invest aggressively or gradually and steadily? Fundrise’s Investment Options give you that flexibility as well. See the image below.

A Word About the Venture Capital Plan

Just imagine if, when Amazon and META (formerly known as Facebook) were first being launched, every individual had the opportunity to invest in those companies like the private equity and venture capital entities … how many more lives would have been changed? With Fundrise, investors can now invest like VC teams.

A Word About Fundrise Pro

When I started on the platform, the buy-in was $500, there was no VC plan, and you had no control over where your money was invested. Now, with Fundrise Pro, you can tweak your investment allocations to your liking.

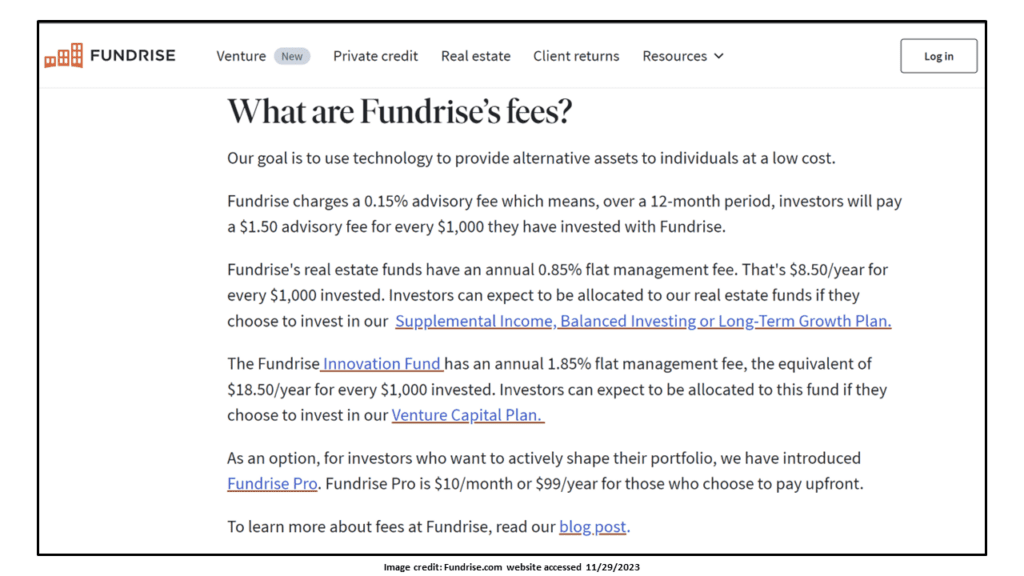

A Word About Fundrise Fees

Like any other investment manager, there are fees associated with your Fundrise account. But, when you consider the hurdles you need to jump and the other pain points of becoming a real estate investor, these minimal fees are worth the effort the Fundrise team puts in on their investors’ behalf.

Is Fundrise Right for You?

One lingering question. Is Fundrise the right investment vehicle for you?

The aim of this article was to introduce you to the Fundrise platform. This is not to say that this platform needs to replace any other investment vehicles (e.g., if you have a 401K, a Roth IRA, or if you’re doing day trading).

I recommend looking at Fundrise, investigating it for yourself, and if it makes sense to you, then adding it to what you’re already doing in terms of other investments (especially if you want to be a real estate investor).

Here are a few questions to help you decide if this real estate investing platform is right for you.

Do you need immediate access to your investment dividends in less than five years?

Are you uncomfortable making monthly funding deposits into an investment (separate perhaps from your 401K)?

Are you living on a tight fixed income and can’t afford to potentially lose money in any investment?

If you answered yes to any of those questions, this platform may not be a good fit for you.

Suppose you are forty-plus years old and looking for additional ways to make long-term investments without the stock market’s volatility. You’re comfortable setting money aside for five or more years. In that case, Fundrise might be great for you. I was looking for an investment opportunity to give me gains over the long term, with steady, gradual growth for ten-plus years (the type of appreciation you experience in your home as a homeowner).

A Special Offer

Thank you for reading to the end. I have an extraordinary offer for you. You can get started today if you’d like. When you use my link (click here), this offer makes you eligible for a $50 voucher for Fundrise shares. If you join the platform, I’ll get a few shares at no additional cost to you. This is a referral program Fundrise makes available to current investors. Remember, you can get started for as little as $10 right now. Don’t wait. Start making wise money moves as you head into 2024. Continue to lay the building blocks of financial abundance for you and your family. You deserve it.

Conclusion

In this article, we discussed the pain points associated with typical real estate investment strategies and explored the real estate investment platform called Fundrise. The platform allows you to invest in real estate from the cozy comfort of your couch without startup headaches. The platform has several investment strategies; you can pick the right one for you (starting with just $10). And, if you take advantage of my Special Offer (click here), you can get started today investing in real estate the easy way and take advantage of my $50 voucher offer for Fundraise shares for no additional cost to you. Happy investing!

Read next: An Honest Talk About Manifestation Done Right

Resource: Average House Price by State in 2023 (Fool.com article).